CEO Chat: PrimaHealth Credit

Company: PrimaHealth Credit (private)

Headquarters: Newport Beach, CA

Year Founded: 2014

1. What problem was PrimaHealth Credit founded to solve?

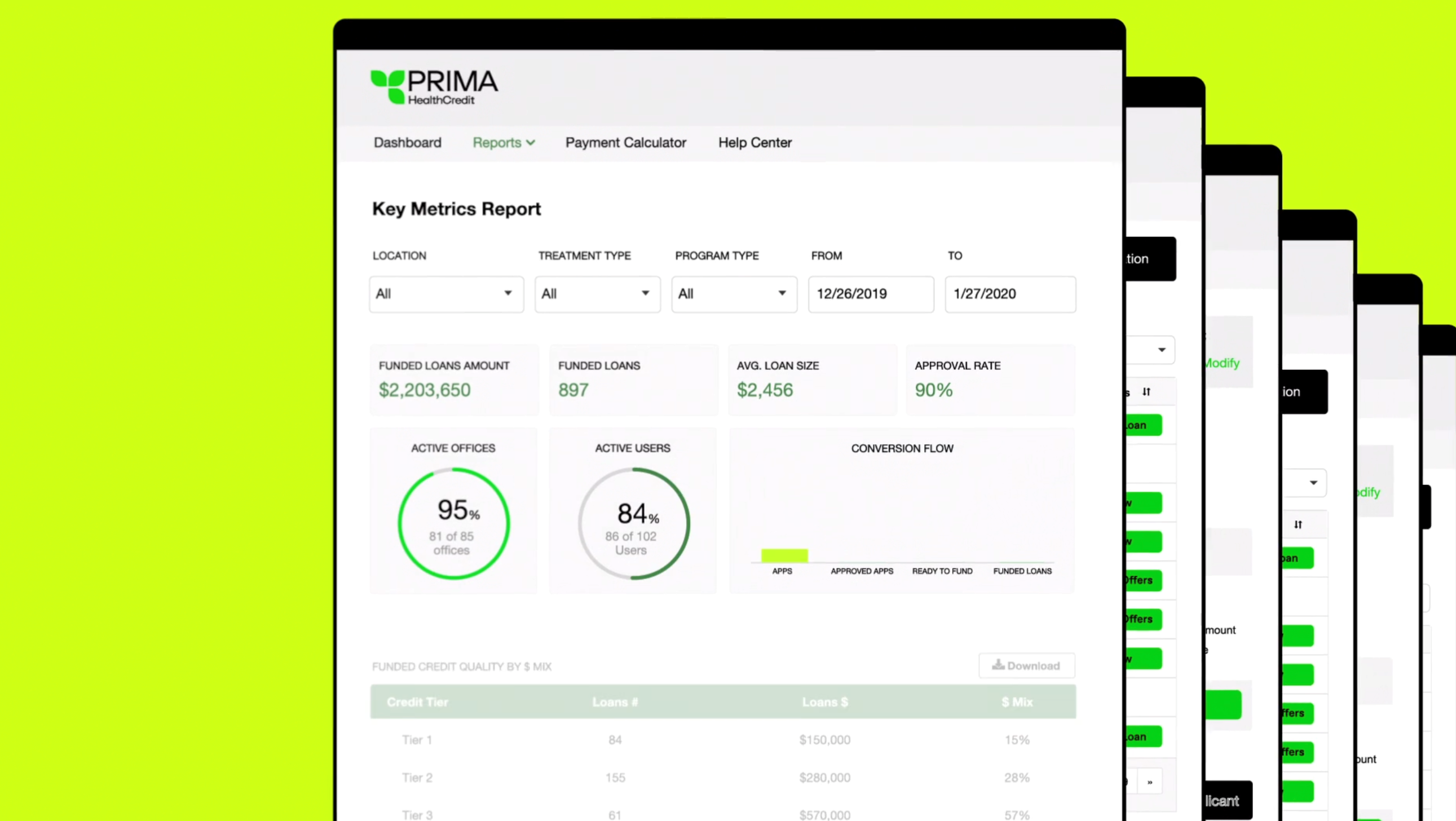

PrimaHealth Credit is a fintech company that’s building the future of patient finance. Our payments solution offers elective healthcare providers a single credit application financing platform that serves patients across the income and credit spectrum. For the first time, most patients – from those with great credit to those with credit challenges – can get the care they need with straightforward and affordable payment options.

As a former operator of an orthodontic DSO, I saw first-hand how patients can struggle to pay for out-of-pocket expenses, and it was heartbreaking when patients could not get approved for financing for themselves or their children. In my view, unequal access to financing solutions has led to unequal access to healthcare. I founded PrimaHealth Credit to solve this and to enable elective care providers to serve patients across the income and credit spectrum with a single credit application.

2. How do you describe PrimaHealth Credit's right to win in your market?

Patients are overwhelmed with the cost of care and are delaying treatment. Providers are juggling too many finance partners in an effort to get their patients approved for care. All of this results in uncomfortable patient conversations and an administrative mess to manage. In short, the experience is broken, and not enough people are getting the care they need. The industry needs one, turnkey solution that allows healthcare providers to profitably care for their patients, while allowing patients an easy-to-understand and honest financing option—this is what PrimaHealth Credit delivers.

We are on a mission to democratize access to care. And that is not something you hear very often in patient finance. It’s easy to finance those with excellent credit. But that leaves too many people without access to care. PrimaHealth Credit was founded because the industry needed one patient finance solution that could approve most patients for care with one credit application. So that’s what we did.

3. What are your key goals and definition of success in the next 12 months?

Over the next twelve months we’ll continue to expand our product offerings to fulfill our mission of enabling more patients to access the care that they need through honest, gotcha-free financing.

%20cropped.jpeg)

.png?width=352&name=image%20(15).png)

%20square.png)