CEO Chat: PayZen

Company: PAYZEN

Headquarters: SAN FRANCISCO, CA

Year Founded: 2019

1. What problem was PayZen founded to solve?

PayZen was started to reshape healthcare payments to make quality care more affordable in America.

Nearly 100 million Americans have medical debt, and stories of people trading their retirement savings to undergo life-saving treatments aren’t uncommon. Bubbling under the surface of these more sensational stories of big losses are some quietly alarming trends that show the day-to-day impact of living in the country with the highest per capita healthcare costs in the world. Our recent Healthcare Affordability Report, which surveyed 1,000 American consumers, revealed that the average patient can afford up to $97 monthly for medical expenses. As insurance companies today pay for a smaller share of increasing healthcare costs, there is a clear misalignment between the out-of-pocket cost of care and the patient’s ability to pay. Patients want to access care and resolve their balances promptly, but their bills are simply unaffordable. Enter a modernized patient financing solution by PayZen.

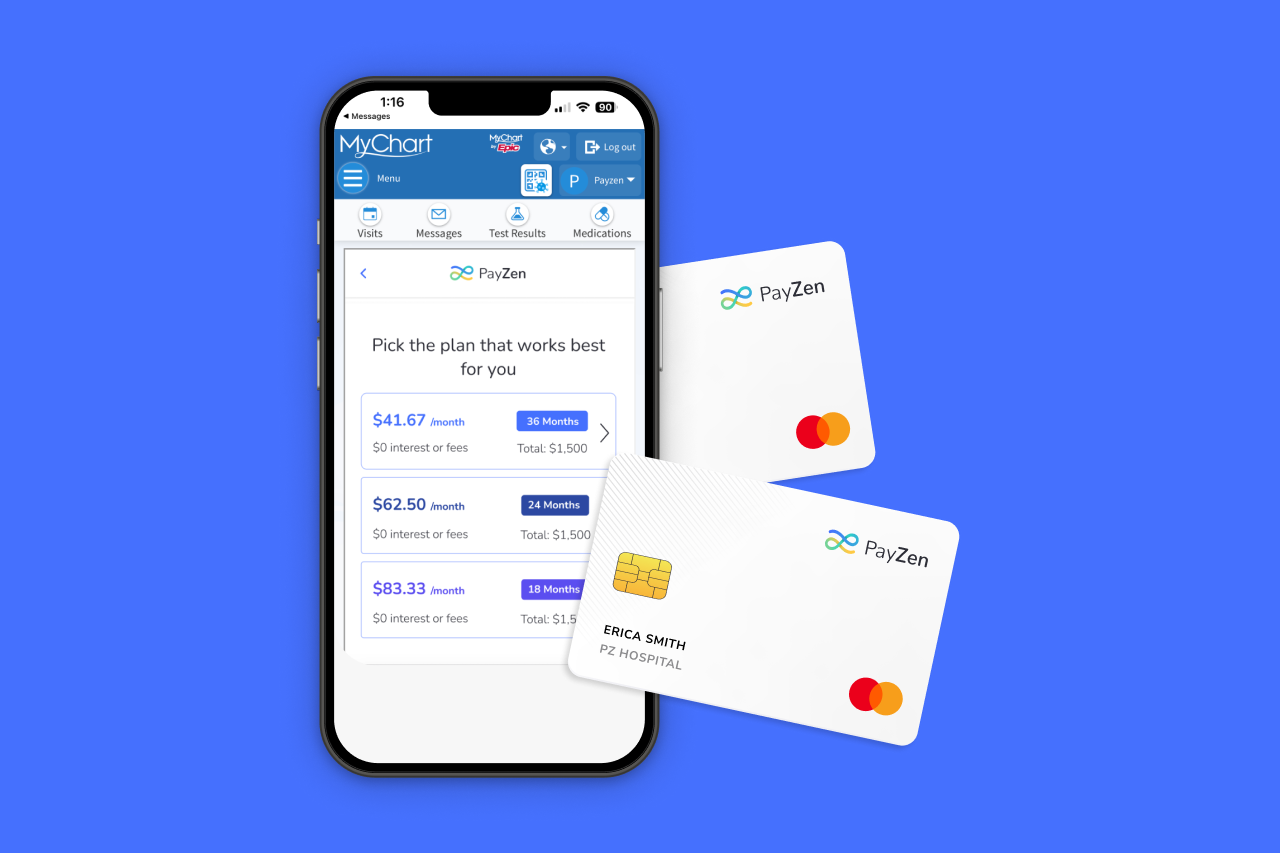

Leveraging proprietary AI models, automation, and seamless integration into EMR/EHR systems, PayZen simplifies the process for healthcare providers to get paid while making it easier for hundreds of thousands of patients to access and afford the care they need. Today, PayZen’s healthcare payment solution identifies patients who need extra time to pay and engages them to enroll in affordable, interest-free payment plans that are tailored to their unique financial situation. Patients can enroll in interest-free payment options either before or after receiving care, and they can budget realistically by choosing from different monthly payment amounts that can extend up to five years.

2. How do you describe PayZen’s right to win in your market?

In the current healthcare payment landscape, traditional options such as credit cards and high-interest loans often exacerbate financial and health disparities. These products can lead to significant debt burdens and limit access to care for individuals with lower credit scores. Additionally, the lack of integration between these financial products and healthcare providers results in a fragmented and inefficient experience.

PayZen distinguishes itself by addressing these critical gaps with a groundbreaking approach. Unlike conventional financial solutions, PayZen’s platform integrates advanced technology and automation with deep data to offer a more equitable and efficient payment experience. Key to PayZen’s healthcare payment solutions and competitive edge is its ability to pre-screen patients for financial assistance eligibility, a feature that ensures they receive the most appropriate and affordable payment options tailored to their specific needs.

Furthermore, PayZen’s healthcare affordability commitment and inclusivity directly counter the issues faced by traditional products, positioning it as a leader in transforming healthcare payment solutions. By prioritizing seamless integration with medical providers and focusing on reducing the financial strain on patients, PayZen is setting a new standard in the industry and demonstrating a clear right to win in the market.

3. What are your key goals and definition of success in the next 12 months?

While PayZen started by helping patients break large care balances into monthly payments, its vision is broader than that: it aims to solve healthcare affordability holistically through future AI-driven products that help eligible patients navigate the financial assistance and Medicaid processes. Within the next 12 months, PayZen hopes to continue developing technology that will fully automate business processes related to patient out-of-pocket balances to direct patients to the best option to afford their care. Additionally, PayZen hopes to build out its list of local and national healthcare partners to reach even more Americans. Such partnerships already exist with premier healthcare systems such as the University of Texas Medical Branch (UTMB), and will only continue growing. In fact, over the next year, PayZen is projected to reach over 100,000 patients on the platform annually.

Learn more about PayZen’s approach to healthcare affordability here

%20square.jpeg)