How will real time payments impact U.S. healthcare providers?

As faster commercial payment standards Same Day ACH, Real-Time Payments (RTP), and FedNow gain traction, is the U.S. healthcare industry on the brink of a financial revolution? Or will it maintain its traditional “late adopter” posture towards payments and pursue a more deliberate course?

The development of Same Day ACH, RTP, and FedNow was driven by the need for faster and more efficient payment processing. All three of these innovations are addressing the demand for speed in financial transactions, and enabling same-day or near-instantaneous settlement of funds. Same Day ACH, for instance, enhances the traditional ACH network by allowing credit and debit transactions to be processed multiple times a day, compressing the typical 2–3-day settlement period to the same business day.

These innovations better meet consumer and business expectations for quicker payments and position financial institutions to remain competitive in a rapidly evolving payments landscape. Cryptocurrencies and blockchain, Peer to Peer platforms such as Square and Venmo, and payment platforms including Adyen, Stripe and PayPal are all threatening traditional banking channels.

Let's take a look at why faster payments are important for health systems and other providers, and have the potential to reshape the way healthcare organizations execute financial transactions.

Why faster payments matter

In the healthcare sector, time is money—literally. Traditional payment methods often involve lengthy processing times, which can lead to cashflow bottlenecks. This is where faster payment systems come into play:

- Same Day ACH: Allows for transactions to be completed within the same day, reducing wait times significantly. Only available on business days. $1M transaction limit.

- Real-Time Payments (RTP): Enables immediate transfer of funds between banks, ensuring that payments are processed instantly, available 24/7. $1M transaction limit (increasing to $10M on 2/9/2025).

- FedNow: A real-time payment service developed by the Fed to facilitate instant fund transfers. Also available 24/7. $500K transaction limit.

Like previous payment technologies adopted by large enterprises, the benefits cannot be only about speed; they need to also be about efficiency and reliability. By adopting these technologies, healthcare providers can reduce administrative burdens and focus more on patient care rather than paperwork. One of the strongest initial use cases of accelerated payments has been reducing employee payroll cycle time. In an era where healthcare workers are scarce and in high demand, improving the payroll experience affecting these employees could be a catalyst for adoption of faster payments in the healthcare industry.

Implications for health systems and providers

Improved Cash Flow Management: Faster payments mean that health systems can maintain better control over their cash flow. This is particularly beneficial in managing day-to-day operations and unexpected expenses. With quicker access to funds, providers can invest in new technologies or expand services without waiting for payments to clear.

Enhanced Vendor Relationships: Healthcare providers often work with a multitude of vendors—from medical supply companies to IT service providers. Faster payment systems ensure that these vendors are paid promptly, fostering better relationships and potentially leading to more favorable terms or discounts. After all, who wouldn't want to be on good terms with the folks supplying your life-saving equipment?

Streamlined Revenue Cycles: By reducing the time between service delivery and payment receipt, health systems can streamline their revenue cycles. This not only improves financial stability but also allows for more accurate financial forecasting. Obviously, U.S. providers need their primary counterparty— U.S. private and public insurers— to be adopters of these payment innovations to realize improved cash flow and fewer days in account receivables (DAR). It remains a question how quickly payers will use any of this innovation to pay medical claims. Float has traditionally been their friend.

Challenges and considerations

While the benefits are clear, transitioning to faster payment systems isn't without its challenges.

Technology Integration: Implementing new payment systems requires significant IT infrastructure changes. Health systems must ensure their current systems can support these new technologies without compromising security or compliance.

Training and Adoption: Staff will need training to adapt to new processes and tools. This includes understanding how these systems work and how to troubleshoot any issues that may arise.

Cost Implications: While faster payments can save money in the long-run, there may be initial costs associated with upgrading systems and training staff. Each of these technologies for faster payments also have their own transactional costs charged by the bank for payment processing.

The future of healthcare payments

U.S. hospitals, health systems and other healthcare providers stand to gain significantly from adopting faster payment networks like RTP, FedNow, and Same Day ACH. These systems not only improve financial operations but also enhance relationships with both vendors and patients. While there are challenges in transitioning to these new technologies, the long-term benefits make them a worthwhile investment for the healthcare industry. Faster payments are set to transform the healthcare landscape, making it more efficient, transparent, and ultimately more patient-centric. So buckle up—the fast lane is coming!

Further reading:

JP Morgan The Future of Healthcare Payments (2023)

Healthcare Payment Processing: 14 Best Tools Your Business Needs In 2025

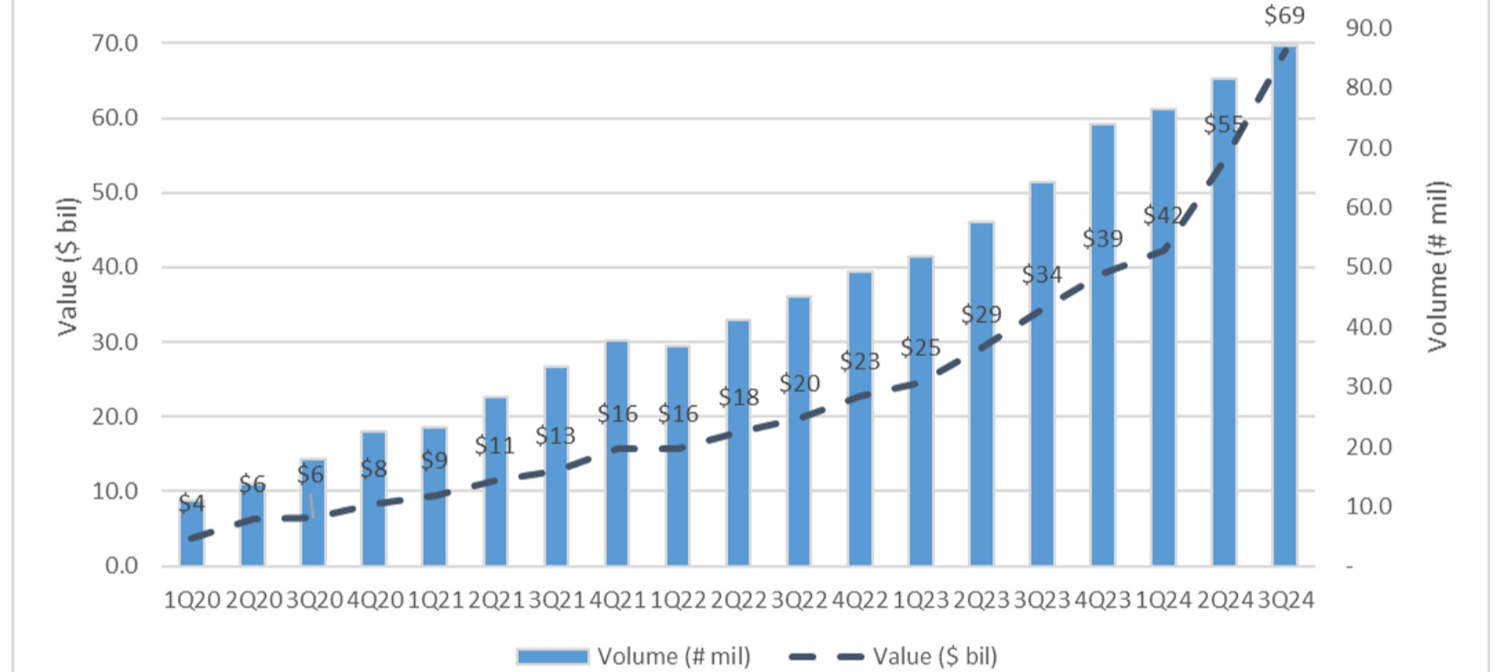

RTP Network Begins November With Record 1.46 Million Instant Payment Transactions

%20square.jpeg)